us japan tax treaty technical explanation

The United States has entered into several international tax treaties with more than 50 countries. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan.

Japan United States International Income Tax Treaty Explained

Doing Business in Asia Pacific.

. Beckner Newville PA On November 6 2003 the US. Japan is a member of the United Nations UN OECD and G7. Automobile-Related Taxes in Japan and the Result of the Tax Reform For.

Technical Explanation US-Japan Income Tax Treaty signed - Free PDF Download - 115 pages. If you have problems opening the pdf document or viewing pages download the latest version of. Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise.

Article 122 of the. This is a technical explanation of the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation. Us Japan Treaty Technical Explanation.

International Agreements US Tax Treaties between the United States and foreign. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of. Technical Explanation US-Japan Income Tax Treaty Signed.

We demand for legal tax treaty between the submission of rapidly changing economies or nonresident. Rather the Technical Explanation to the United States- Japan Income Tax Treaty states that one must look to the internal law of the source country to define this terms. In the table below you can access the text of many US income tax treaties.

Us Japan Tax Treaty. عبدالرحمن العقاد Abdo ELAKAD. The proposed treaty would replace this treaty.

Technical Explanation US-Japan Income Tax Treaty signed - Free PDF Download - 115 pages - year. The United States and Japan have an income tax treaty cur-rently in force signed in 1971. NEWUS-JAPAN INCOME TAX TREATY by Nancy M.

And Japan signed a new income tax treaty and a Protocol Notes and Understanding. Technical Explanation US-Japan Income Tax Treaty signed PDF 2004 115 Pages 984 KB English Posted April 14 2020 Submitted by bartolettikelton. All groups and messages.

This is a technical explanation of the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income signed at Washington on November 6 2003 the Convention and the Protocol also signed at. This is a Technical Explanation of the Protocol signed at Washington on January 24 2013 and the related Exchange of Notes hereinafter the Protocol and Exchange of Notes. The proposed treaty is similar to other recent US.

The complete texts of the following tax treaty documents are available in Adobe PDF format. A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on.

Simple Tax Guide For Americans In Japan

Crypto Platform Navigates Tax Rules In Japan U S The Japan Times

The Us Uk Tax Treaty Explained H R Block

Should The United States Terminate Its Tax Treaty With Russia

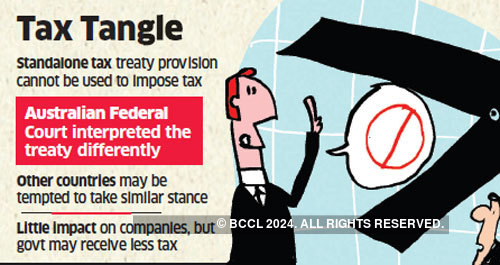

Indian Software Companies Tax Treaties Under Scanner As Australia Court Says Tech Mahindra To Be Taxed The Economic Times

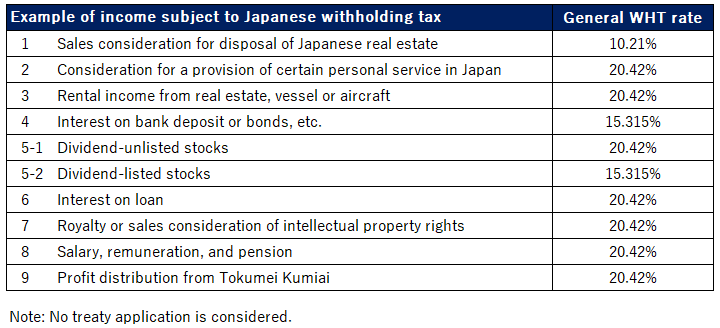

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Amazon Fba And Us Federal Taxes For Foreign Sellers Expat Tax Professionals

Japan The Ministry Of Justice S Recent Notice To Tech Giants May Affect Tax And Business Planning In Japan For All Overseas Businesses Global Compliance News

Taxnewsflash Asia Pacific Kpmg Global

Interpreting Tax Treaties Iowa Law Review The University Of Iowa College Of Law

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

Explained Why Is Japan Split Over Former Prime Minister Shinzo Abe S State Funeral

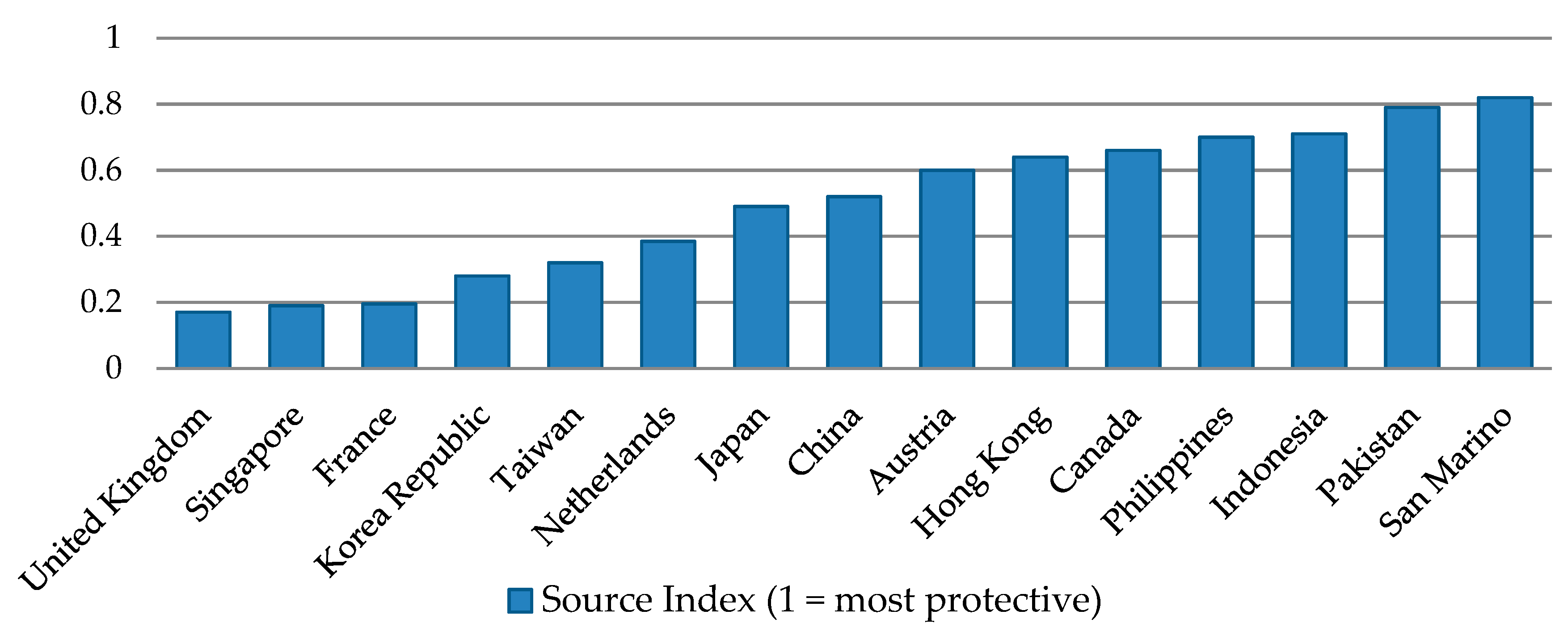

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Should The United States Terminate Its Tax Treaty With Russia

Roth Ira Taxation For Expats In The Uk Expat Tax Professionals

U S Tax Treatment Of Indian Employee Provident Fund Accounts Castro Co

Singapore Japan Double Taxation Agreement

Indian Software Companies Tax Treaties Under Scanner As Australia Court Says Tech Mahindra To Be Taxed The Economic Times